Can you remind us of the background against which the company opted for external growth, and its challenges? Was this planned from the point when support started to be given?

Pierre-Louis Beaud. Making an acquisition is a significant strategic choice. The acquisition of NTOC is one of the reasons why we have partnerd with Initiative & Finance in 2020. I had already considered acquiring another company a few years previously – a project I did not actually start because I had no support.

Laurent Dehan. We have completed five external growth deals with Initiative & Finance, which was not part of the initial plan. But we shared the same dynamic view of growth. In our business sector, growth is possible either organically by establishing local branches, or by acquiring local competitors. We preferred the second solution, because it’s faster and easier. We made our first acquisition in 2017, a few months after Initiative & Finance became a shareholder.

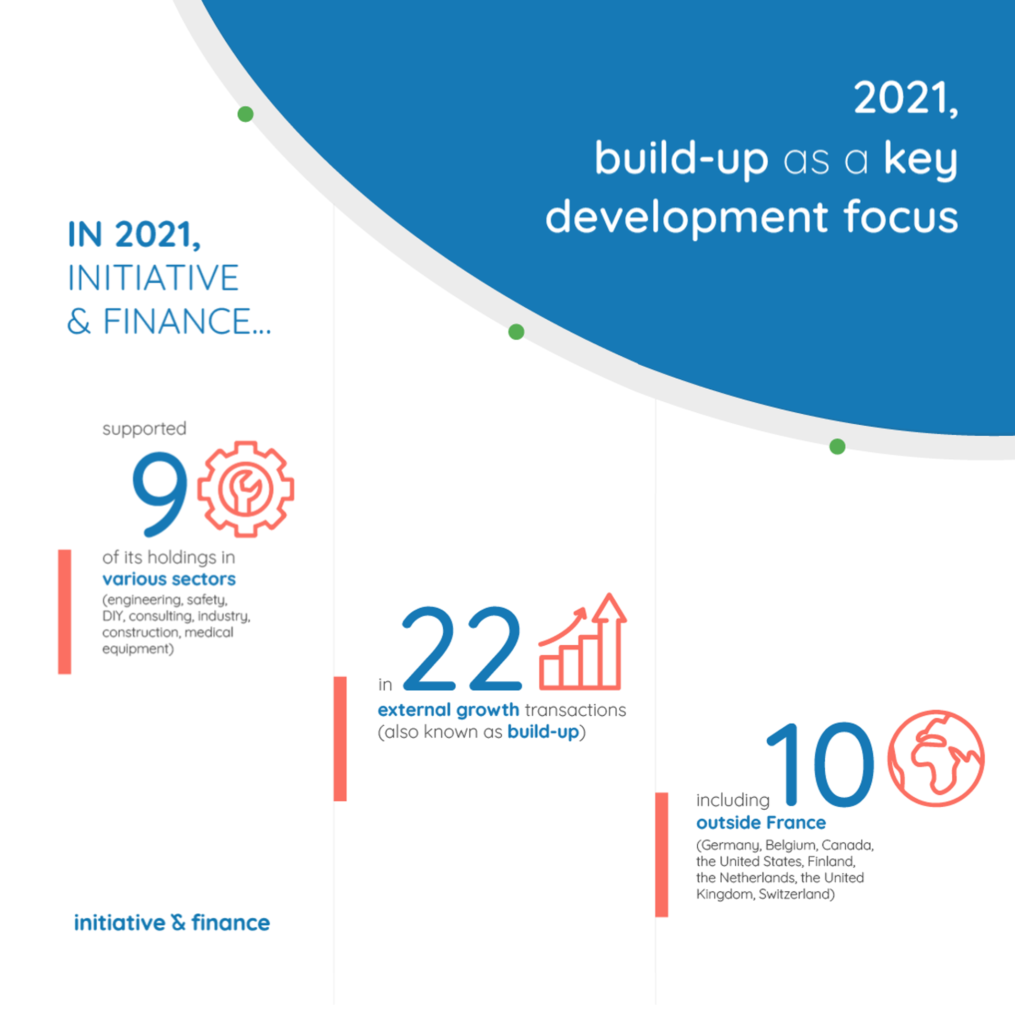

Jean-Michel Laveu. Initiative & Finance first acquired a stake in Briconord in December 2020. The company had already carried out a significant build-up in the Netherlands before this and, after our investment, we completed three acquisitions, which were highly targeted in terms of products. Two were the result of a takeover from CDE Blangis group, the third came from our direct approach in the field: a Lyon family firm where part of its business as regards product range, stockists and marketing strategy matched Briconord’s own positioning.

What role did Initiative & Finance play?

P.-L. B. We are in a niche market, with only a few firms in Europe, and very few who are independent. So I knew NTOC. Initiative & Finance held a first meeting at the end of 2020, discussions really started in early 2021 and the acquisition process ended in early 2022. In my experience, the first phase of contact, before the seller and buyer have agreed in principle, is the most delicate, and the involvement of a third party, such as Initiative & Finance, made it easier. They are professionals and they have largely taken charge of the subsequent acquisition, from due diligence to contracts and relationships with banks. Without their support, I would not have completed this transaction.

L.D. Initiative & Finance was responsible for getting in touch and organising the first meeting, but it’s true to say that the whole process is a combined effort. For example, in the search for potential acquisition targets: Initiative & Finance managed acquisition files, contacts with lawyers and consultancies, and I was on the operational side dealing with integration of the acquired companies. In addition, a fund such as Initiative & Finance has flawless knowledge in terms of raising borrowing, banking arrangements and liquidity management. This provided me with immediate insight into how we could finance these acquisitions.

J.-M. L. We mainly supported the MD, in terms of credibility as regards obtaining financing, in analysis of the target and in determining a balanced price. We played a leading role in the negotiation and execution of transactions, as well as in actually identifying the family firm in Lyon.

What were the benefits for the companies supported?

P.-L. B. This acquisition has enabled us to not only expand our product offering but also open up new markets – a real “cross-pollination” effect. NTOC has, for example, unlike Inomed, obtained its CE marking. In addition, NTOC’s headquarters are in the Netherlands and this European base is an advantage, at a time when exports to the European Union could suffer from the breakdown in trade negotiations between Berne and Brussels. The NTOC acquisition is changing the company’s image. Our revenue has doubled and we have become the European leaders in sterilization baskets, with several production sites and a wide range of products. This position strengthens our credibility and opens up routes to other clients.

L.D. We tripled our revenue in the time between the initial stake taken by Initiative & Finance and the sale of Fermatic last year, and we increased from around fifty employees to more than 200. External growth is a very good development and value creation mechanism for the company. It has enabled us to become a national leader in our sector and then to attract a major international player seeking diversification.

J.-M. L. Briconord doubled in size! These transactions also brought some momentum to the group’s construction, which was in a growth phase, both external and organic. It also boosted customer satisfaction, as they generally prefer to reduce the number of their suppliers while having access to the widest possible range of products, so whether viewed at an operational, product or customer level, these build-ups have been beneficial!

What advice would you give to a company executive who is thinking about embarking on external growth?

L.D. There is no better solution than being assisted by a player that combines flawless legal expertise with flawless knowledge of the banking system. Partnering with an investment fund means having easier access to financing because banks are reassured by their presence. It also means having a partner who is a real help through their constant support, in securing lending and in organising capital. And Initiative & Finance understands the issues of SMEs, they have comprehensive knowledge and it’s very reassuring for executives who want to grow their business and understand that some aspects will be more complicated than others.

P.-L. B. For SMEs, support and guidance is necessary to deal with the complexity of such a transaction. And beyond this support, trust is fundamental. As a stakeholder, Initiative & Finance has the interests of all partners at heart.

J.-M. L. The first advice is to snare the right investor! An investor who has experience in external growth, and who stands shoulder to shoulder with the companies they support. There are many factors in an acquisition phase, not just financial. My second piece of advice is to get started when you know exactly what we are looking for. So build a thorough checklist, do not rush, but do not delay unnecessarily. Finally, do not underestimate the importance of merging organisational cultures. For a family mid-cap, it is a question of analysing, independently of the figures, the management style and the culture of the company potentially being acquired to check that it matches: once committed it can be hard to turn back.

And what did you gain from these transactions?

P.-L. B. I found all the work done around this acquisition very stimulating, and I really want to repeat the experience to develop a European sterilization basket platform. As a company director, this acquisition also changes my job description, giving me responsibility for making the group resulting from the merger of the two companies work. It’s exciting.

L.D. If it had to be done again, I would do it again, and with the same partner, because it is also about the people involved.

J.-M. L. I find that these transactions represent all of the most interesting elements, combining the financial aspect, corporate strategy and bringing teams of staff together. These deals first and foremost involve people, and are very strong business accelerators when they are done properly!

Back to the thematic folder

Back to the thematic folder